10 Hotel Trends to Watch in 2022

Reading Time: 9 minutesLooking back on 2021, I am proud to see how much hotels have once again pulled together and grown through waves of change and uncertainty. Despite the twists and turns of changing restrictions, 2021 has been a year to remember in terms of pent-up travel demand, and how hotels have adapted to it.

You’re probably wondering now: “What’s in store for hotels in 2022?” From our perspective, we anticipate that a number of the trends that emerged during the recession will continue in 2022, including hotels’ direct interaction with guests, the focus on local tourism

In this article, I share what is expected to be the top 10 Hotel Trends to Watch in 2022.

10 Hotel Trends to Watch in 2022

2021 was a bit of a rollercoaster, with shifting tides from the hope of widespread vaccination, to new variants, and, somehow, hotel bookings exceeding pre-pandemic levels over certain periods of the year. Hotels are expected to keep up this momentum, but we will also see a number of new market developments.

Below are the top 10 Hotel Trends to watch in 2022:

1. OTAs will revert to aggressive visibility marketing strategies, and Hoteliers will need to fight harder for direct bookings

Since 2020, hotel direct bookings have continued to grow exponentially, showing the most resilience during the crisis and recovering stronger in the wake of resumed travel demand. However, the end of 2021 is already showing signs that some of the major players in the OTA space are ramping up marketing investments and offerings to grasp recovery momentum.

Phocuswire reports that Booking.com more than doubled its marketing spend in Q2 of 2021 to $988 million, up from $461 million in Q1, 2021. Looking ahead, the giant stated plans to leverage campaigns similar to its “Back To Travel” initiative, launched in the US in April and in the UK in May, offering travel credits for future stays. Expedia has also stated that it has “pushed aggressively into marketing” ahead of 2022. Its Q2 earnings report reveals adjusted selling and marketing expense for the period was almost $1.2 billion, a 320% increase year-over-year.

OTAs typically focus on closed groups, such as Booking’s Genius program, and have free reign to adjust their rates however they see fit. Since the start of the pandemic, Booking and other OTAs significantly lowered the barriers for guests to enter these closed groups, which essentially means the OTAs have free reign to offer lower rates. Although independent hotels could, in theory, establish a closed group in a similar manner, they do not have as much reach as the OTAs.

Thus, we anticipate that Hotels will need to fight harder in 2022 to get more direct bookings. Hotels won more direct bookings in 2021 by virtue of domestic travel and the uncertain climate, where guests are more likely to interact directly with the hotel. Once it’s back to business as usual, and international markets reopen, hotels will likely see a dip in direct bookings.

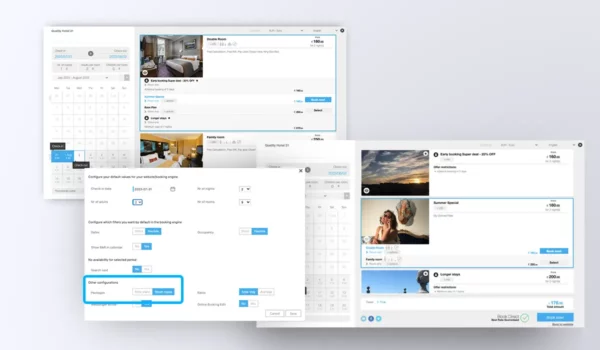

But hotels must remember that their strength lies in how their websites convert visitors into guests. In 2022, hotels need to ensure the direct channel has the best value. While it may not be possible to beat the giants in terms of visibility, hotels will need to ensure their direct channels (including mobile) clearly guide consumer decisions and drive direct sales.

2. Hoteliers will focus strongly on reducing labor shortages and upskilling their workforces

When the world shut down in 2020, hotels in the US laid off approximately 6.2 million employees. As some states opened up, the industry saw a third of these jobs recover last summer, though the ongoing pandemic stalled any hope of a quick bounce-back.

France’s hospitality sector estimates that 150,000 workers have left the industry. In Germany, union experts estimate that every sixth worker ( almost 300,000 people) left the sector last year. There are about 200,000 vacancies in the sector in Britain, where the effects of the pandemic have been compounded by Brexit.

Hoteliers need to attract and retain new talent, while also reducing the drain on the existing workforce by motivating them in their jobs. Technology will help to solve the issue, not only in the short term but to make existing teams more effective, by allowing staff to develop meaningful connections with guests, instead of spending many hours on processes.

As demand and occupancy continue to increase, hotels must now ensure they have the skilled people to cater to an influx of guests. Hoteliers will be strongly focused on growing and upskilling their workforces in 2022. According to our ongoing Hotelier PULSE research, the majority of Hoteliers surveyed have ranked ‘Upskilling the Workforce’ among the top priorities for a stronger recovery.

3. AI and Automation will be widely adopted across the industry, as a means to reduce operational costs without compromising service

Due to the social and travel conditions caused by Covid-19, guests now increasingly value more efficient interactions with hotels that clearly guide purchasing decisions. Hotels must respond to this demand in 2022.

Given current labor and cost constraints, we expect widespread adoption of AI technologies, including Virtual Assistants, ChatBots, Big Data, and Machine Learning, from hotels in 2022. This will better enable hotels to respond to increased customer demand, without compromising service. Hotels will want to ensure that they have the software that enables employees to deliver a better and more efficient service at a fraction of the time and cost to the business.

According to a new market research report published by Global Market Estimates, the AI in Hospitality Market will grow with a compound annual growth rate value of approximately 10% from 2021 to 2026. High technical adoption in the hotel industry owing to change in business operations impacted by the covid-19 pandemic will support the industry growth. Due to coronavirus, various industries opted for digital transformation tools to optimize and regularize their operations.

It’s evident that there is a strong connection between adopting AI that streamlines the guests’ stay at all stages, thus freeing up the best team members in the hotel to truly engage with guests when and how they need them – i.e. concierge services or proactive guest relations.

4. Independent Hotels will be challenged to Communicate Uniqueness in Google’s Marketplace

In early March 2021, Google announced the launch of its Hotel Free Booking Links program, giving Hotels free listings as a non-paid extension of Google Hotel Ads. This gave hotels the opportunity to increase online visibility and direct bookings in a space once dominated by paid advertisers such as Booking and Expedia. This led to widespread hotel listings on the Google Hotel Free Booking Links program.

However, by flooding the search engine results with booking options, Google is creating a crowded marketplace, thus forcing hotels, OTAs, and other booking websites to compete for visibility and think about how they can stand out. Hotels will need to be strategic about communicating uniqueness in the Google marketplace.

One of the obvious options is to participate in the Hotel Ads Commission Program. This CPA (cost per acquisition) model means hotels will pay Google a commission when a reservation is done and not per click, as is the case with Google Ads. This shows Google is moving to the OTAs model where hotels can work with a commission based on the rate booked, just like Booking or Expedia. However, this could likely result in a bidding war where the biggest investors win in terms of visibility.

However, there is a huge opportunity in the Google marketplace to encourage publication of and respond to guests’ online reviews. Many hotels focus on OTA review management, but not only is Google the more valuable and channel-agnostic option, it has also trumped Tripadvisor in many markets already.

5. Hoteliers will continue to respond to market changes with agility, and focus strongly on tackling new markets

Where possible, Hotels must continue to embrace flexible cancellation policies as people are still anxious about how the pandemic will evolve. This will continue to give potential travelers the confidence to book. To help assure bookings, many hotels now offer cancellation refunds in the form of a credit towards a future stay. This is likely to continue in 2022.

Furthermore, with limited flight capacity and guests actively pursuing destinations within their own countries, there has been a significant shift from air travel to rail, bus and car travel. Hoteliers will need to think about strategies to put in place in light of this new demand, offering free parking and other perks towards the drive market.

Hotels should also be on the lookout to tackle new markets, as they did in 2021. Some opportunities include celebration backlogs from 2020 and 2021 into 2022 or revenue management in the weddings and private celebrations market.

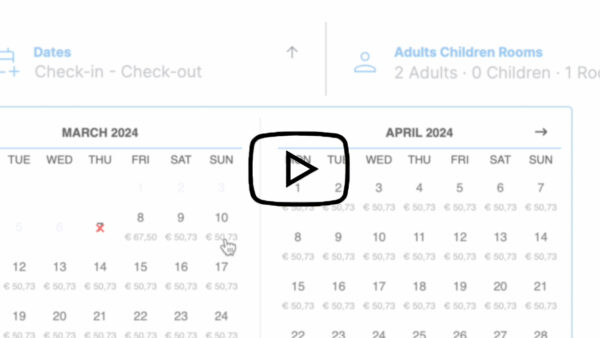

6. Mobile Bookings will keep Growing, and Hotels will need to Adapt

By the summer of 2020, according to the data processed by over 1,500 hotels within Guestcentric’s portfolio, mobile bookings increased to over 24%, almost one-quarter of all hotel bookings. This rise in mobile hotel bookings shows no sign of slowing down. On average in 2021 over 40% of total bookings in 2021 (vs an average of 27% in 2020). In effect, this means that mobile bookings doubled in just two short years. We expect this trend to continue in 2022 and beyond.

According to forecasts by KPMG and Facebook, 9 in 10 bookings will be mobile by 2022. In December 2021, year to date, Guestcentric’s research shows that mobile represented nearly 30% of total bookings.

Because there is not as much time to get someone to book via mobile compared to other devices, hotels will need to efficiently eliminate doubt for guests booking via a mobile device. We expect that many hotels will continue optimizing their mobile websites in this regard, offering concise and straightforward content, easy links to contact the hotel directly by phone and push mobile-only offers.

7. 2022 May bring Uneven Business Travel Recovery, and Hotels will need to be Prepared

In a major new report by the World Travel & Tourism Council (WTTC), published in early November 2021, the WTTC forecasts business travel spending to reach two-thirds of pre-pandemic levels in 2022. “Business travel has been seriously hit but our research shows room for optimism with the Asia Pacific and the Middle East first off the starting blocks,” WTTC CEO & President Julia Simpson said.

Considering this year and next, WTTC data shows which regions around the world are leading the revival in business travel, led by the Middle East:

- Middle East: Business spending is set to rise by 49% this year, stronger than leisure spending at 36%, followed by a 32% rise next year

- Asia-Pacific: Business spending is set to rise by 32% this year, and 41% in 2022.

- Europe: Set to rise by 36% in 2021 (stronger than leisure spending at 26%) followed by a 28% rise in 2022.

- Africa: Spending is set to rise by 36 percent in 2021, slightly stronger than leisure spending at 35%, followed by a 23% rise in 2022.

- Americas: Business spending is expected to rise by 14% this year, and by 35% in 2022.

The WTTC believes that while business travel will return, its uneven recovery will have important implications across the global Travel & Tourism sector, making private-public partnerships even more important in the months and years ahead.

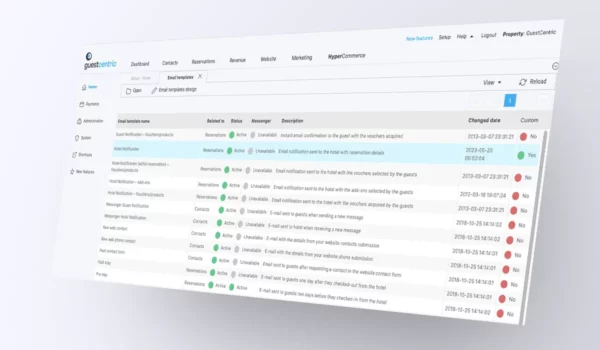

8. Hotels will continue direct interaction with guests

Hoteliers are also expected to continue direct interaction with guests over the course of 2022. Now, more than ever, guests require increased communication-related at all stages of their travel experience, using channels such as WhatsApp or Social Media Messenger apps from the likes of Facebook and Instagram.

Furthermore, staying connected with past and future guests and building a strong brand relationship is critical during these uncertain times. Hotels will likely continue to promote exclusive offers and perks to loyalty members throughout 2022.

9. Sustainability will continue to be top of mind for hotels in 2022

According to Skift Research, 83% of global travelers believe sustainable travel is vital. In addition, according to Booking’s Sustainability Report 2021, 73% of travelers would be more likely to choose an accommodation if it has implemented sustainability practices. Of those surveyed, 61% said the pandemic made them want to travel more sustainably in the future.

But that’s not all. According to Futtera’s latest study in the US and UK, 88% of consumers want brands to help them improve their environmental and social footprint.

As consumers grow more aware and concerned about the social and environmental impact of their travel footprint, upholding environmental sustainability will continue to be essential for businesses to achieve growth, attract new clients, and satisfy customers in 2022 and beyond.

10. Bleisure Travel and Hotel Spaces will be in greater demand

Working remotely has today become commonplace for many employees and is forecasted to become more than just a passing trend. A shift accelerated by the global public health crisis, an unprecedented number of high-profile companies – with big tech companies like Twitter, Facebook, and Amazon leading the way – announced that they will adopt a hybrid or flexible approach to working remotely.

According to a recent MICE study by Great Hotels of the World, published in December 2021, Bleisure trumps in group business, and clients need hotels to provide exciting team-building, leisure, and outdoor activities to regroup and align their teams. Over 70% of Hoteliers report that small groups request leisure and outdoor activities. The study also showed that over 46% of hotels currently offer Staycation packages and rates, while over 23% offer workcation rates for long stay work/holiday.

This means that hospitality venues are being used as make-shift offices for bleisure travelers, as well as locals seeking a change of work environment. This is a great opportunity for hotels and F&B venues to capitalize on the trend and adapt their offering to meet the needs and wants of this emerging segment; ample plug sockets, free high-speed WIFI, and great coffee are good starting points.

Conclusion

With increasing customer demand, labor shortages, and upskilling the workforce will continue to be high on the agenda for Hoteliers in 2022. We anticipate widespread adoption of AI technologies to maintain an optimal level of service at less cost, and with smaller teams. AI is set to largely reduce repetitive and administrative tasks, allowing staff to add more value.

In terms of sales and marketing, we anticipate that OTAs will significantly ramp up marketing and challenge hotels in 2022. In tandem, Google’s marketplace is also set to become increasingly competitive for independent hotels to compete.

Notably, Mobile bookings are on the rise ahead of 2022, and with a shorter booking pace associated with these devices, Hoteliers will need to ensure their mobile websites provide a concise visitor and booking experience.

In terms of sales and marketing, Hoteliers will need to become more aggressive in the hunt for direct bookings, ensuring their websites offer the best value to guests and drive more direct bookings. Hoteliers must also seek out the opportunities in the current climate, pivoting their offer toward new markets and demands that may arise in these uncertain times.