Crisis Management – It's About Response and Planning For the Upturn

Reading Time: 4 minutesOur industry is now in crisis management mode and all eyes remain focused on the development of COVID-19 and its disruption to hotel operations and the wider travel economy worldwide.

While it can be difficult to predict with any certainty what might come next, we continue to analyze similar events that have previously unfolded and rely on the power of data to help us and our partners make informed decisions. This, in turn, will better prepare you for the upturn that will eventually come.

Information, analysis, and planning are critical for all hoteliers currently facing challenging operating conditions due to COVID-19. Therefore, we have in record time built and developed a smart COVID-19 benchmark dashboard to give you increased visibility into how this crisis is unfolding and the potential impact on your business.

How It Works

Our dashboards are designed to help you identify key market trends that continue to emerge as the crisis unfolds, thus enabling you to prepare the best strategy to adapt and prepare for what’s to come.

Our dashboards also enable you to benchmark your property’s performance against other properties in the market. For this purpose, the market defined by over 200 hand-picked hotels within our database which represent a good mix of properties.

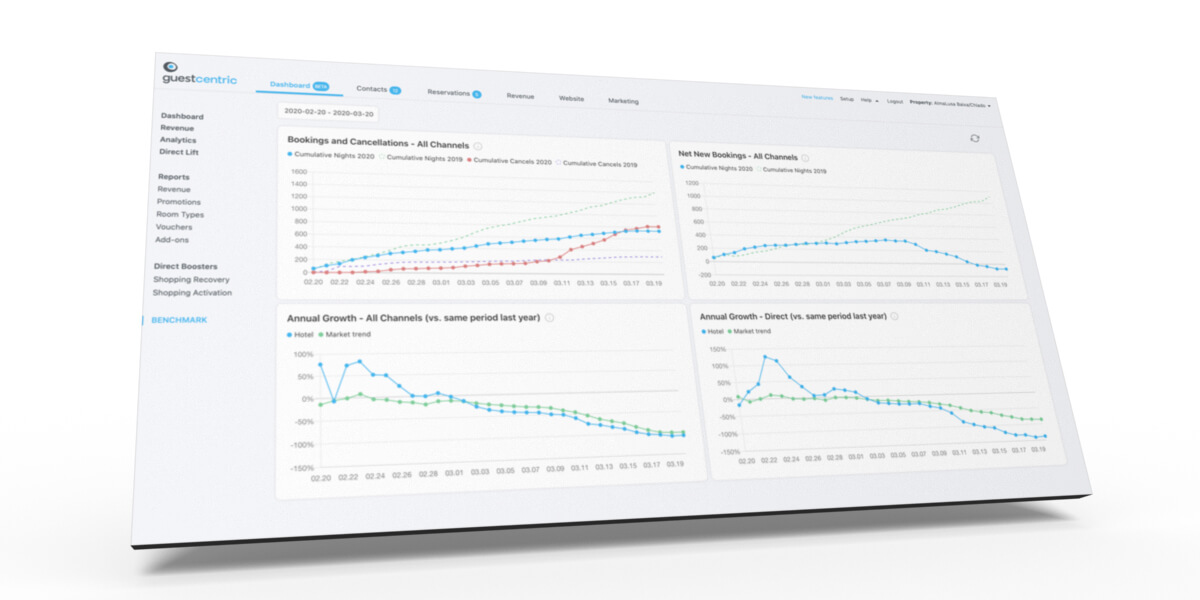

Here’s a closer look at what each panel means:

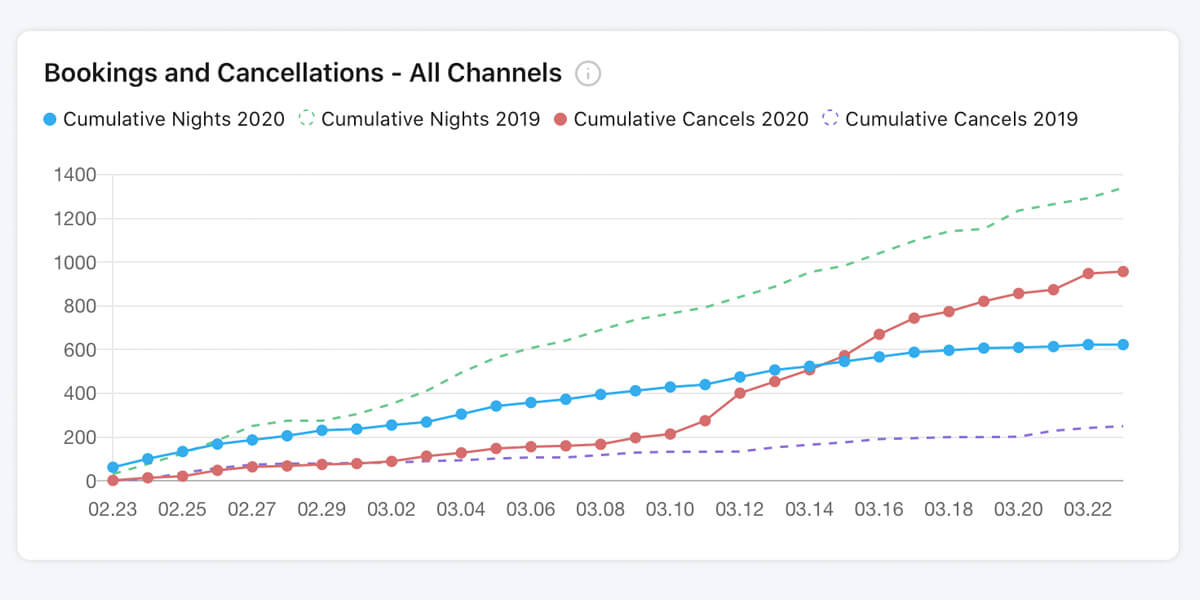

Bookings & Cancellations – All Channels

This panel allows you to analyze your current bookings and cancellations across all channels over an allocated in the current year vs the same period in the previous year.

The blue line represents cumulative nights booked over an allocated period vs the green line which represents cumulative nights booked in the previous year during the same period. The red line shows the cancellations made over this period, compared to the purple line which represents cancellations over the same period in the previous year.

For example, as you can see in the graph above bookings have flat-lined over the selected period, with a rise in cancellations of nights that were booked over a period of approximately 6 days prior. We expect the cancellations will begin to plateau as time progresses, but when that time comes exactly remains to be seen.

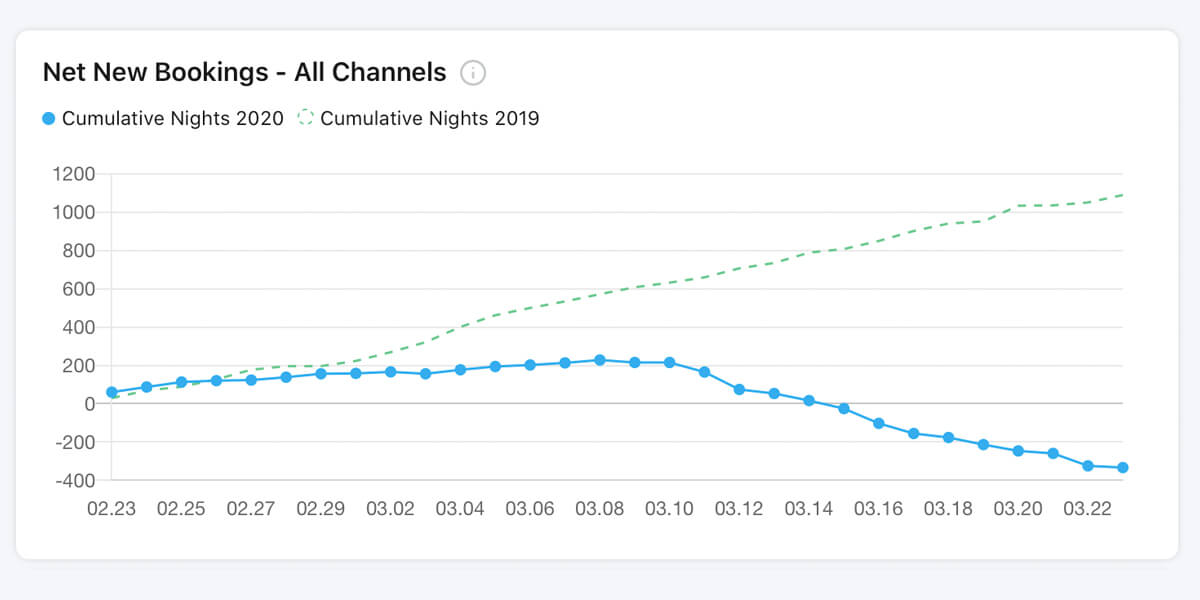

Net New Bookings – All Channels

This panel represents the relative performance of your hotel over an allocated period vs the same period in the previous year. This panel shows all bookings minus cancellations, providing an overview of growth over an allocated period in the current year vs the previous year.

The green line represents bookings in the previous year, while the blue line represents bookings in the current year. As you can see, bookings in the current year and the selected period have dropped over the last two weeks.

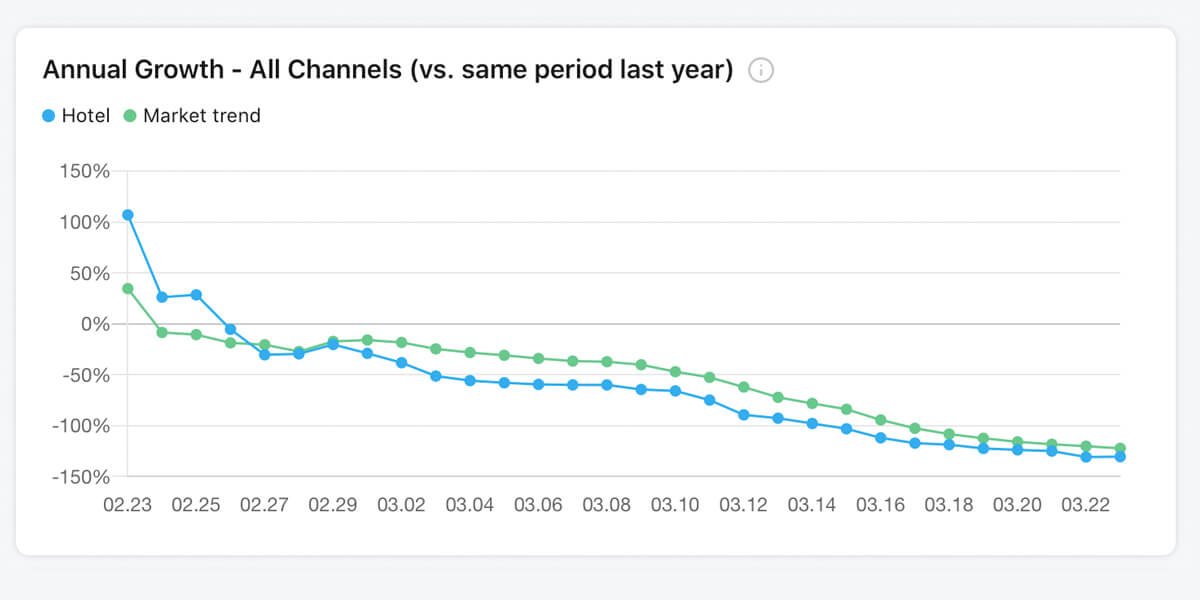

Annual Growth On All Channels vs Same Period In Previous Year

This benchmarks your hotel’s growth on all channels against the market in the current year. The market is defined by over 200 hand-picked hotels across the Guestcentric database which represent a good mix of properties.

As you can see in the last date displayed in the graph above, the market is down 42%, while the sample hotel is down 48%. This example shows how you can use the panel to get an understanding of how your hotel compares against the market over an allocated time frame.

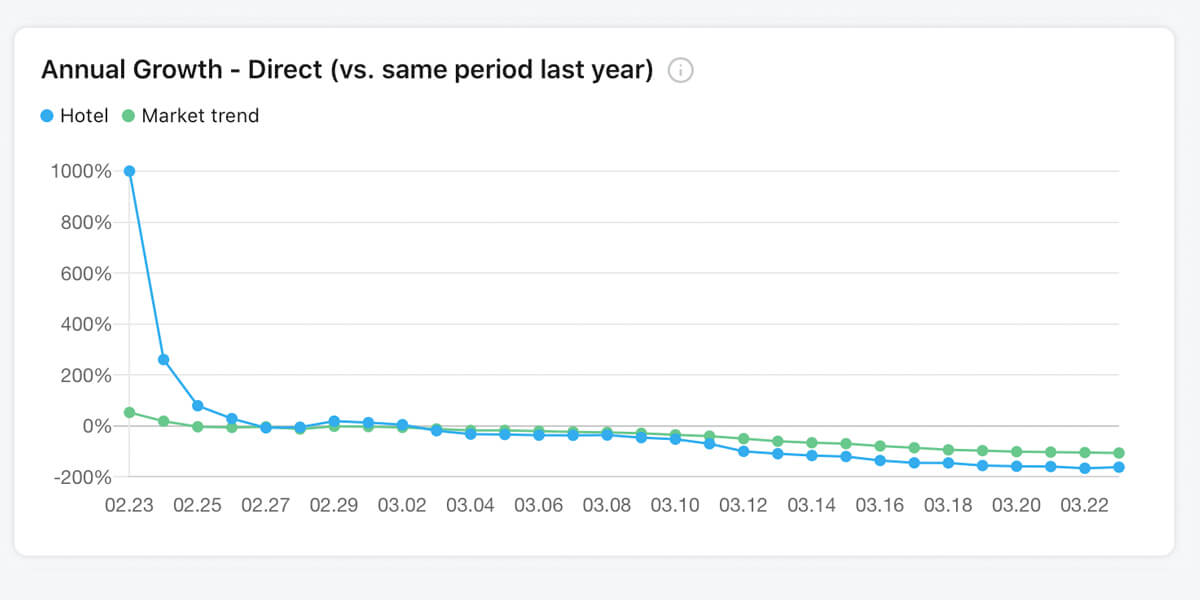

Annual Growth Direct vs External Channels against Same Period In Previous Year

This panel is designed specifically for properties with more than one channel for reservations. Once again, the blue line represents your hotel’s direct channel while the green line represents external channels.

In the example above, you can see that the market is down 30%, while the direct channel is down 53%. This gives you an idea of how you can compare your direct channel performance against the external channels you use over an allocated period.

Conclusion

What goes down must come up, and while the spread of COVID-19 is having a direct impact on many hoteliers’ forward-reservations, some signs are encouraging for the future.

Things are starting to pick up across China’s domestic travel market. Travel data provider ADARA reports a rebound in searches and bookings for flights to and within China – the first market to be severely impacted by COVID-19.

After a sharp decline in February, global unique travelers searching for flights to and within China increased beginning in March and were up 29% for the week beginning March 8 compared to the week of March 1. The total volume of searches is also starting to increase. The current volume is 55% of what it was in early January – up from a low of 34% in mid-February.

In the meantime, try to make the downturn as productive as possible. Train your people and review your plans for investing in long-term success. Additionally, when travel bans are released, tourist arrivals will rebound, and hoteliers will have opportunities to attract new guests from new markets and build a wider customer pool for long-term success.

If you have any questions on how to navigate the dashboards, please do not hesitate to contact us.