Google – Your Hotel's New Worst Best Friend?

Reading Time: 6 minutesOver the past 10 years, the likes of Expedia and Booking.com (the so-called OTAs) have become some of the most significant sources of bookings for independent hotels. All OTAs, but most notably Expedia and Booking have grown by relying heavily on Google to drive new customer acquisition and bookings.

However, Google´s recent move to cram the top of its search results with ads is driving competition for that real estate. Ad pricing is up, creating customer acquisition cost problems for the online travel industry.

Expedia Group fell the most in 14 years and TripAdvisor dropped the most in two years after both companies reported dismal third-quarter results and laid the blame on Google. Booking.com´s shares also plummeted by 8%, wiping out a combined market value of over $13 billion from all three OTAs.

As Google continues to disrupt the online travel market by increasing customer acquisition cost and taking a bigger slice of the pie, the big question this article will be asking is: ‘Could Google be your new worst best friend?´

The Relationship Between Google and OTAs

Google dominates at least two-thirds of the online search market. With millions of users researching trips and destinations globally, OTAs have refined their websites with trustworthy content and easy booking tools to ensure they position high in Google search results.

Historically, OTAs have served hotels on a pay-for-performance model and held power over them by trying to control demand and bookings. However, it’s important to note how OTAs now generate this demand, which is where Google comes into play.

OTAs generate demand to their websites with a combination of Search Engine Optimization (SEO) and Pay Per Click (PPC) advertising. This strategy has long been beneficial to both parties. Google drives traffic to the OTAs, which, in aggregate, make an estimated $100 billion via commissions extracted from suppliers.

Google, meanwhile, not only receives relevant results it could serve to customers but also makes tens of billions of dollars from OTAs buying search ads.

This all began to change when Google started placing more ads at the top of the search engine and pushing down free organic listings from OTAs. The internet giant also built new travel search tools, which were mostly paid listings. This means OTAs must now pay billions each year to Google to ensure they rank high in search results and get clicks from travel planners.

From Partner to Competitor – The Rise of Google Hotel Ads

Until now, Google has always denied any firm intention to engage in direct travel sales. Its business model has historically focused on offering an intelligent search engine that points to third-party sites and features advertising on its platform and affiliated networks.

But the launch of Google´s destination hub ́Travel ́ sent fresh waves of concern throughout the OTA community. Hoteliers and other competitors can now set up their own destination packages on Google, including flights, hotels, and attractions for any given destination.

Google Hotel Ads auctions a diverse range of bidding strategies to hoteliers and OTAs to consider. These include CPA (cost-per-conversion), Target ROARs (for partners with 100+ hotels), Enhanced Cost-Per-Click and Commission strategies.

When a customer executes a search that would result in Hotel Ads being displayed, Google first grabs eligible prices for hotels and then runs the auction. After the results of the auction, Google displays the ads with the winning bids to the end-user.

There are a number of factors that affect whether a customer qualifies for inclusion in the auction. For example, rates from a customer´s hotel must match the end-user’s exact itinerary.

With the Google Hotel Ads feature, hoteliers can manage the distribution of their inventory directly on the Google platform and promote rates with Google Ads. More importantly, with the Room Booking module, they can also encourage potential customers to book directly within Google, without leaving the mobile app.

Mobile users represent approximately 50 to 60% of all bookings, which is more than hotel website users in 2019. It is therefore unsurprising that Google has also optimized this feature for mobile.

Google Disrupts the Online Travel Market

Google´s dominance has been an increasing risk for the online travel industry, but executives have been generally hesitant to blame the search giant for poor results. Google is one of the most important sources of traffic and business for OTAs, which is why these companies have tried to maintain a good relationship.

But in the 2019 Q3 earning reports, the reality of Google’s grip and impact on the online travel market was so painful that industry executives and Wall Street analysts could no longer ignore it.

Shares of Expedia and TripAdvisor both reached new year-to-date lows during midday trading, tumbling as much as 25% after both the travel service stocks reported third-quarter earnings misses. Both companies pointed to weakened visibility in Google search results as a long-term revenue headwind.

Former Expedia CEO, Mark Okerstrom said: “What we saw was a continued shift of essentially the free links further down the page, by other modules that were inserted and ultimately a shift of traffic from the SEO channel over to some of the other products whether it’s flight metasearch or hotel metasearch over time.”

“Now of course as related to the hotel product, the lodging product, we are able to pick up some of that volume and that ultimately resulted in spending more on sales and marketing than we otherwise would have.”

“Google has gotten more aggressive,” CEO Steve Kaufer said of TripAdvisor´s quarterly earnings call. “We’ve been predicting this of course for the past many years. We talked about it on our last call. We know that this SEO piece is an ongoing trend and we’re not predicting that it’s going to turn around.”

Booking Holdings ́ CEO Glenn Fogel was also peppered with questions about Google following the group ́s earnings report. The response indicated that the company’s future success would rely on reaching people without Google getting in the way.

He said: “What we know is most important is for us to get customers to come to us directly,” he said. “Building brand strength and retaining customers better means the company will not be as dependent on other sources of traffic”.

What Does This Mean For Hoteliers?

Google´s rising power over OTAs is probably heralded by independent hotels as good news. The ability to compete with OTAs on a level playing field like meta-search gives hotels ultimately the power to get more direct bookings.

However, increasing customer acquisition costs from Google are bound to have a ripple effect across independent hotels globally. Many rely heavily on OTAs to increase visibility and generate bookings, but what will happen when OTAs are locked in a bidding war for the top spot on the Google search engine?

Bidding directly on Google will likely become difficult for independent hotels and OTA commissions will likely soar to pass through the extra costs.

Some experts predict a massive shift where OTAs will no longer be the dominant reservation channel. Up until now, Google has predominantly operated as an ad agency, generating clicks and driving traffic which then converts into transactions for companies on the search engine.

But as the threat of Google monopolization looms, there will likely be a bidding war between Expedia, TripAdvisor, Booking.com and direct channels. The higher everyone bids, the more money Google will generate.

This begs the question: “Do independent hotels – with less resource and financial leverage – stand a chance?”

The silver lining is that in parallel with paid advertising, Google has been strengthening their Google My Business tools to give visibility to the business owners. Now more than ever, Hoteliers will need to invest in smart online solutions to both level the distribution playing field and generate the best possible return on investment.

The Next Step for Hoteliers

As it stands, 87% of guests will visit a hotel‘s website before making a reservation. Therefore, it is essential that hoteliers implement a comprehensive digital sales and marketing strategy to optimize the guests’ experience and drive conversions.

Google is likely to expand its foothold on the travel industry, either by acquisitions or by bringing competitors to the edge of irrelevance. The trend is unlikely to revert, so it’s time hoteliers wake up from their TripAdvisor-centric approach and start investing where the volume (and ROI) is.

Below, is a short summary of our recommendations:

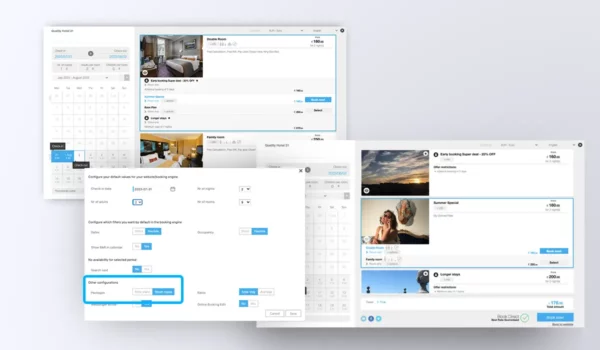

Optimize your website and booking engine: It is vitally important that both your website and booking engine are optimized for direct. A few ways you can optimize include featuring pictures with your special offers, ensuring both website and booking engine are mobile-friendly and featuring shopping activation/recovery widgets. For example, our research shows that including shopping activation and shopping recovery widgets can lift direct bookings by up to 60%.

Be smart about your bidding: Google Hotel Ads campaigns are very sophisticated, with hundreds of variables and, very likely, this complexity and sophistication will increase with the upcoming Hotel Ads/Ads merge. Rate leakage is one of the main reasons why many campaigns underperform, so bidding should be very dynamic, based on your future rates, availability, and feeder market depending on seasonality.

Continuously update and engage with Google My Business: Make sure your Google My Business listing is always up-to-date, as this is the primary entry point for most Google users. Answer to ALL users questions on Google My Business and reply to the Google reviews. If you have time only for one platform, then drop TripAdvisor and focus on the Big G.

Diversify your traffic channels: Focus on other aspects of digital marketing to drive direct bookings, such as social media referrals, influencer marketing and user-generated content.

Most importantly, never lose sight of the customers’ experience at all stages of their interaction with your hotel.

Organic growth requires a comprehensive strategy, and many hotels wait at least 12 months before seeing real, tangible results. If you fail to plan, you plan to fail, so to help you get started, here are 5 Digital Marketing Strategies for your Hotel to Win Direct Bookings in 2020.

Contact one of our specialists for more insights like the above.

*You may also be interested in: Booking.com – Your Worst Best Friend?

Dayara Resort

Really the most helpful post in knowing about Google and Hotel business effects due to Google policy. Thanks for sharing the Blog.