Travel Demand is Back – Is Tourism Ready?

Reading Time: 6 minutesWhen travel will recover is no longer a question of consumer demand, but when restrictions will be lifted. In the US, vaccination is progressing at a swift pace, with most states fully reopened for business and hotel bookings exceeding 2019 values. In Europe however, tourism is still anxiously awaiting when local governments will end travel bans and fully reopen destinations.

As uncertainty prevails, it is vital for all sectors within tourism to share information and collaborate on the road to recovery. In this article, we catch up with Aviation and Tourism expert, Gavin Eccles to explore the current status of consumer demand and the driving factors. He also shares how all tourism sectors from hotels to airlines should collaborate for a more agile response to changing restrictions and a stronger recovery in the upturn.

When Travel will Resume – No Longer a Question of Consumer Demand

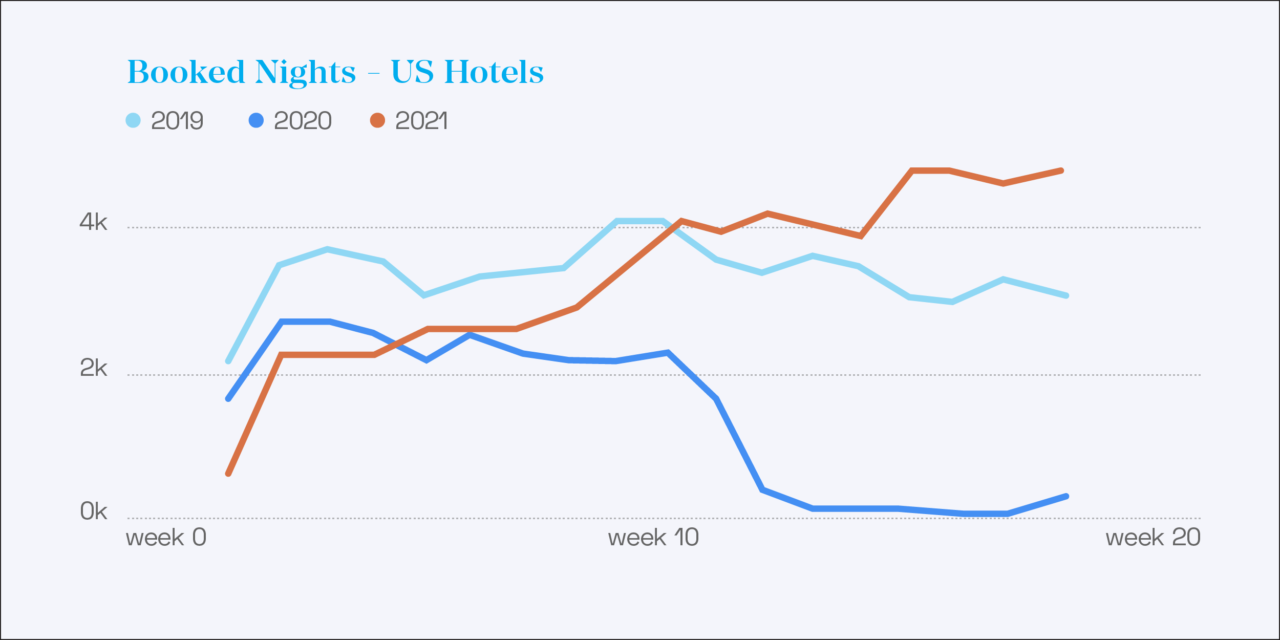

In February 2021, swift vaccination and partial reopenings in the US and UK triggered a boom in travel confidence, reflected in both flight and hotel bookings. According to Guestcentric’s hotel CRS data, published in the March 2021 edition of The Hotelier PULSE Report, US bookings in February 2021 rose to 95% of those over the same period in 2019. Meanwhile, UK hotel bookings rose to 76% of those over the same period in 2019.

In April 2021, the US appears to be all but fully reopened. Vaccination is progressing at a steady pace, and public gatherings such as Spring break have returned with a vengeance. Guestcentric’s market trends analysis also shows that between March and April 2021, hotel bookings in the US reached and exceeded 2019 levels.

However, ongoing vaccination hurdles and restrictions in Europe and the UK mean that bookings are still lagging significantly below 2019 levels. Only now in April are hotel bookings beginning to overtake those over the same period in 2020. However, bookings hit rock-bottom over this period last year, therefore the industry in Europe is still recovering slowly.

And yet, market signals also indicate that consumers are eager to travel again, yet reluctant to book trips due to rapid changes and restrictions. In March 2021, The International Air Transport Association (IATA) announced results from its latest poll of recent travelers, revealing growing confidence in a return to air travel, frustration with current travel restrictions, and acceptance of a travel app to manage health credentials for travel.

According to the survey responses, 57% expect to travel within a few months of “COVID-19 containment” (up from 49% in September 2020). This is supported by vaccine rollout, which indicates that 81% of people will be more likely to travel once vaccinated. However, 84% of travelers will not travel if it involves quarantine at the destination.

What is Influencing Consumer Confidence to Travel?

Although travel confidence spiked following the UK’s roadmap to reopen the economy, announced in February 2021, travel confidence soared, it has since declined.

Highlighting the key factors influencing consumer confidence during this time, Gavin Eccles, Consultant & Professor of Aviation & Tourism said, “Although demand was booming, the wave of optimism was soon followed by a number of negative signals that significantly impacted consumer confidence. From UK Government alterations to the roadmap, sensationalist media coverage, and the recall of the AstraZeneca vaccine across various destinations in Europe.”

“Even the BBC had to rephrase a headline which boldly announced “No Travel this Summer!”, because the government had never agreed this would be the case. But despite the correction, some damage had been done. This doesn’t mean consumers don’t want to travel. Rather, they are understandably skeptical about booking trips abroad with so much uncertainty,” He continued.

Despite wavering restrictions and fluctuating consumer confidence, overall hotel bookings net of cancelations in March 2021 more than doubled bookings over the same period in 2020, according to the market data published in the 13th Edition of The Hotelier PULSE Report.

Hoteliers surveyed in March 2021 also seem increasingly confident in significant pent-up consumer demand once local governments lift the travel bans. Previously dominant issues such as health & safety concerns, tighter consumer budgets, and flight capacity are no longer expected to be a barrier to travel when borders reopen.

How can Tourism Capture Pent-Up Travel Demand?

With pent-up demand on the horizon, it is essential for all facets of tourism, from hotels to tour operators and commercial airlines to keep an open line of communication and coordinate efforts. Businesses will also have to uphold competitiveness in order to capitalize on the demand. “How hotels or airlines capture the returning demand will depend on what businesses do to remain competitive, as well as the level communication and coordination across the wider tourism industry,” says Gavin.

Below are two key factors the tourism industry will need for a stronger recovery in the upturn:

1. More Collaboration Across the Tourism Industry

We live in an era where anything can change at any time. Therefore, the tourism industry needs to be agile enough to react quickly and capitalize on the upturn. “Airlines are ready to go when governments give the greenlight. If consumers feel confident to travel, they will travel, and airlines will have the supply to meet this demand. Hotels (and vice-versa) need to be aware of these developments and act accordingly” says Gavin.

In anticipation of increased international travel when the world reopens, Gavin emphasises that hotels need to be in tune with airline capacity as destinations reopen. “Airlines have effectively planned to ensure an agile response, and can easily re-station aircraft to destinations that have reopened,” he says. “Therefore, it is crucial that hotels are positioned and open to receive the rush of incoming travelers.”

However, Gavin notes the responsibility to connect and collaborate more closely with the wider tourism industry does not rest solely on hotels. “Airlines, tour operators, and national tourism boards also need to be aligned with the status of overseas destinations. It costs too much to keep aircraft on the ground. This means if passengers book flights to overseas destinations, and don’t cancel before the flight date, the airline will fly. But if the departure point is open to travel, while the destination is heavily restricted, it’s unlikely many hotels will be open to receive guests,” he says.

“We also need better cohesion between tourism boards across various destinations,” he continues. “We’ve seen some tourism boards, such as Cyprus, be extremely proactive by targeting UK tourists to visit, but, at this point, the UK is still not open to travel,” he added.

2. More Flexibility in Current Cost and Future Revenue Management

Predicting future revenues under the current circumstances is near impossible. Therefore, all businesses from hotels to airlines need to be alert and flexible about how they manage future revenues and costs. Gavin notes, “In the aviation sector, some expect prices to increase in the upturn, while others expect reductions to stimulate the demand. But if the demand is there, would hotels or airlines really want to discount?”

Successful recovery will largely depend on how hotels, airlines, and other areas of tourism can adjust operating costs to uncertain and varying levels of market demand. Businesses can also collaborate to effectively manage operational costs – for example, through partnerships between hotels and restaurants that create cost synergies like shared housekeeping services or food outlets.

During these uncertain times, businesses have also been forced to adapt to shorter-term cost and revenue planning. Referring to aviation specifically, Gavin notes, “By this time in a ‘normal’ year, airlines would typically be planning trips for the summer of next year. But with the situation still uncertain, weekly and monthly network planning has been established to proactively manage cost and revenue, and respond to changes with agility.”

Reducing inventory during periods of low demand can also help keep costs down. In terms of future revenue, Gavin also notes that businesses need to be mindful of deferred business. “Many airlines, and I am sure hotels too, have given customers the option to reschedule bookings to a later date. When destinations reopen, we will likely see an avalanche of consumers rushing to reclaim bookings at virtually the same time. Hotels and airlines must be ready to manage this possibility.”

But When will Travel Reopen on a Global Scale?

While the industry can only speculate, Gavin believes that digitalisation will better ensure compliance with health measures and ultimately determine when travel will reopen on a global scale. “Within aviation there is a big push for digitalisation to ensure travelers have either tested negative for the virus or have been vaccinated,” he says.

He maintains the two-fold approach to digital documentation is essential at this stage, given that a large percentage of people are still not eligible for vaccination. “But ultimately, this documentation will need to be digital in order to mitigate the risk of human error, similar to pre-clearance and using QR codes.”

Conclusion

Based on the signals in the market, we know that pent-up demand is growing faster by the day and revenge travel is on the horizon. The US market is a good prediction of what’s to come. Whether it’s minimizing current operational costs or optimizing direct sales channels, hotels and the wider tourism industry can and should take action now to strengthen their position and effectively capture the pent-up demand.

But with the global travel climate still so uncertain, it is still critical that the industry continues to share information and coordinate efforts for a stronger recovery. Remember, tourism needs to be agile enough to react quickly and capitalize on the upturn, which is likely to strike fast and hard.

Tim

Great article, and all good points. I believe, however, that the hospitality and tourism industry needs to offer more reassurance to prospective clients that should things take an unpredicted turn for the worst and we slip into yet another global lockdown just as the world begins to open up, then a swift return of the monies paid, rather than the lengthy reimbursement shambles millions of tourists had suffer through last year, would go a long way to helping the industry too.