3 Hotel Forecasts for Winter 2022 to 2023

Reading Time: 6 minutesAt the start of 2022, we predicted 7 market trends for Hoteliers to be optimistic about in 2022. After what has truly been a euphoric and record-breaking summer for hotels, it’s interesting to observe which of our predictions came to fruition. More on that in a moment…

Now in September 2022, hotels are looking to the future in anticipation and perhaps some concern. The ongoing conflict in Ukraine, rising energy prices, and inflation are just a few factors increasing concerns about what’s in store for hotels in winter 2022 and 2023.

In this article, we revisit the predictions we made at the start of the year to see what we got right, and offer three possible scenarios for hotels to proactively prepare for in winter of 2022/2023.

So, did Hotels really have 7 Reasons to be Optimistic in 2022?

Looking back at 2022 so far, we conclude that of the 7 predictions we shared in February 2022, 6 of them came true! And although occupancy still has not exceeded 2019 levels, record-breaking ADR levels and direct bookings have brought up total revenue significantly in comparison to that period.

Without further ado, here are the predictions that came to fruition:

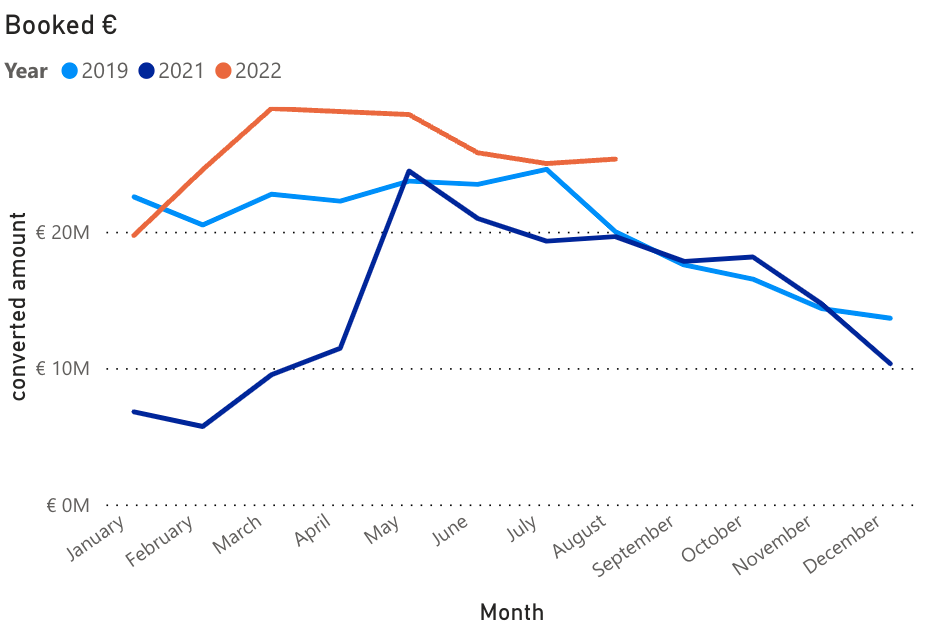

1. 2022 Could be the Best Year Ever for Direct Bookings

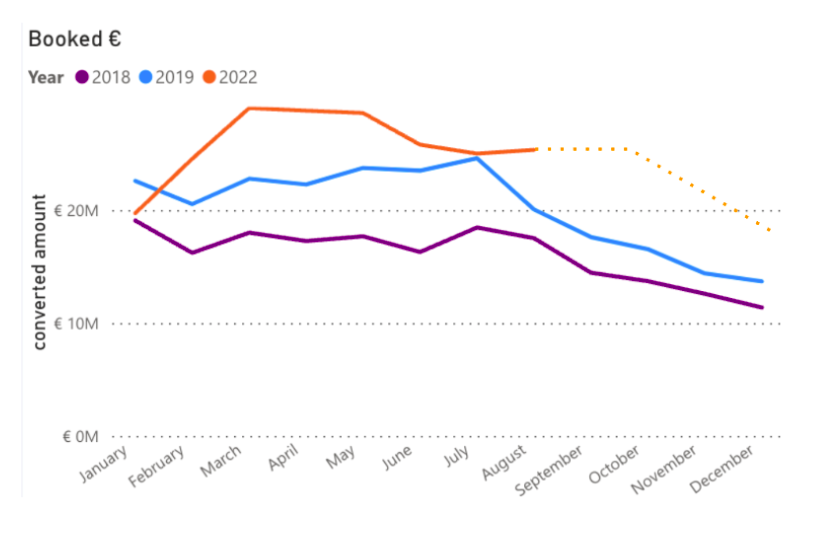

After direct bookings bounced back in 2021, we predicted that 2022 would potentially be the best year ever in terms of direct channel performance. The graph below illustrates just how direct bookings in 2022 significantly outperformed 2019 levels.

2. Demand is back in 2022

Summer 2022 boomed with travel demand! Despite China being practically barred from outbound travel this year, Aviation Expert and Travel & Tourism Consultant Gavin Eccles reported in August 2022 that total seat capacity was just 14% below 2019 levels.

“When you consider that China is not contributing to international travel currently, we can see that capacity and demand recovery is moving far quicker than consultants suggested back in 2020. Currently, capacity is at around 100 million seats per week, which is a threefold increase compared to 2021. Back in 2020, we had around 15,000 aircraft parked, and by February 2022 we were down to around 8,000,” he said.

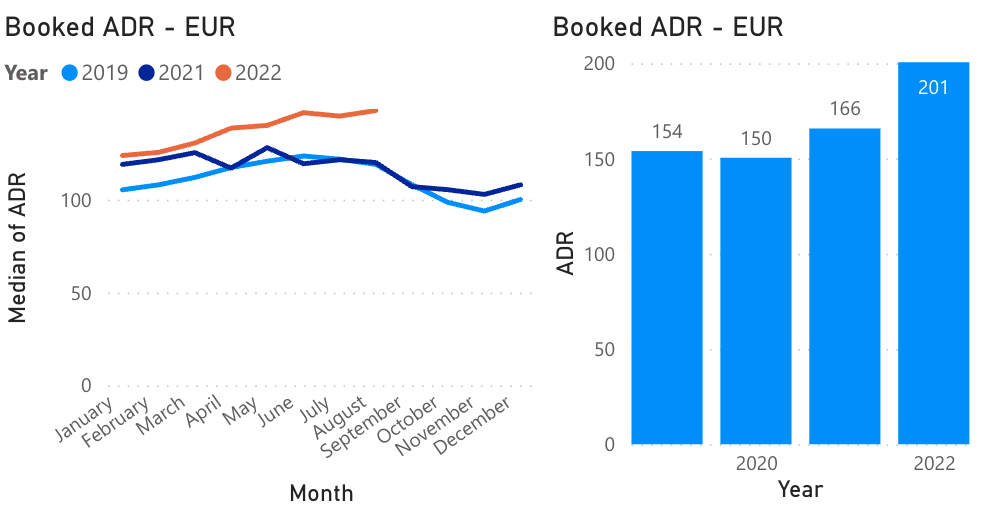

3. Pricing is through the Roof

Although occupancy has yet to exceed 2019 levels, increased ADR has largely compensated for this. Price, combined with more direct bookings has brought overall revenue approximately 8% above 2019 levels YTD, according to Guestcentric market data released on September 11, 2022.

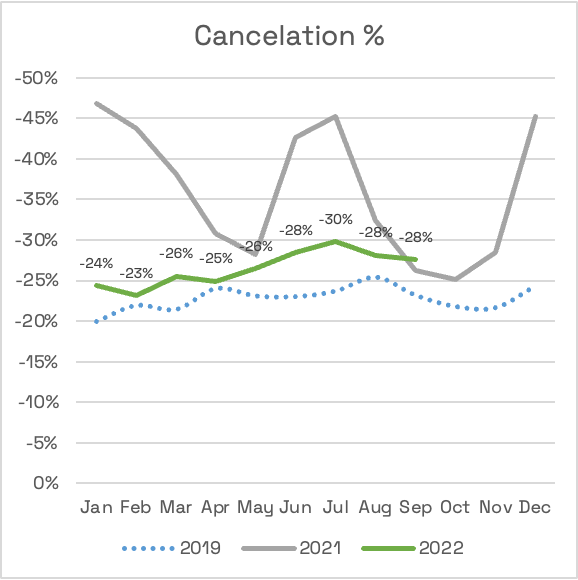

4. Cancellations are back to Normal

We all saw the sensational headlines in the press, of seemingly endless queues at the airport and flight cancellations at the last-minute. But despite this, hotel cancellations remain relatively stable in comparison to 2019 levels, and much less volatile than in 2021.

In terms of flight cancellations, Gavin also noted: “ There has been a great deal of negative press surrounding endless queues, flight delays and cancellations. The reality, however, is that a small number of travelers are affected relative to the bigger picture. Just 2% to 3% out of 100 million passengers have experienced flight cancellations over the summer of 2022. And, it was 1% in summer 2019.”

5. Corporate Travel could Bounce Back in 2022

In an interview with Rita Machado, VP of Sales & Marketing at Great Hotels of the World, she observed that corporate travel is resuming through Bleisure. “Although GDS bookings have certainly recovered, because of energy and sustainability concerns, coupled with more remote working than ever, post-pandemic, international business travel is still nowhere near 2019 levels – and perhaps never will be again.”

“However, it has definitely evolved into something different. In recent years, and particularly throughout the pandemic, more professionals and digital nomads now weave their work lives with their personal lives, and corporate travel is pivoting to the leisure market as a result,” she continued.

“In 2022, we’ve seen a major spike in GDS bookings for resorts and other leisure-centric hotels. The more agile and far-seeing travel agencies are developing strategic partnerships with corporations, even if not necessarily for corporate travel. These partnerships are proving to be an effective strategy in 2022 and beyond,” Rita concluded.

6. Hotels are Confident Traveling in 2022

Not only are consumers confident about traveling again, but more hotels are also hitting the road in 2022 to meet buyers and investors. The last 2 quarters of 2022 are seeing GHOTW hotel members attending trade shows, sales missions and other sales events at levels comparable to 2019. After two years of online trade relationships, both sides are keen to meet and do business in person.

What can Hotels expect in Winter 2022 to 2023?

Although it is impossible to predict the future with 100% accuracy, we can and should work on scenarios based on available market data, to prepare for the coming year a On a daily to monthly basis, we at Guestcentric continuously analyze data generated from thousands of hotels within our portfolio, that provides a good indication of what to expect in the future.

To help your hotel strategy for Winter 2022/2023, we have created three possible scenarios to support you. These are as follows:

- Winter like 2019: We must note that current market signals are pointing strongly in this direction

- High winter demand with lower prices: There is widespread speculation this will be the case based on inflation and potentially less travel as a result.

- Market disruption followed by decline in demand (similar to 2018 levels): The worst case scenario, which would be most likely to take place in the event of another Covid-19 lockdown or similar disruption. We must note however, this seems unlikely to happen at this stage.

The graph below shows all three scenarios for you to consider:

1. A Winter like 2019

This is undoubtedly the most realistic scenario for hotels and current market signals are strongly pointing in this direction. However, it is also the most called into question when considering rising fuel costs, inflation, the conflict in Ukraine, and other factors impacting consumers’ wallets.

But according to Guestcentric market data documented at the start of September 2022, the Autumn season is looking promising for hotels in terms of on-the-books revenue. September is looking extremely positive, October is accelerating, and November and December 2022 are aligning with 2019 levels.

We must also consider the very real possibility of pent-up demand for the Autumn and Winter as high prices and massive travel disruption over the summer may have caused consumers to postpone travel, which will now come to fruition during what is typically the lower season.

2. High Winter Demand with Lower Prices

Given the factors mentioned above, this is widely speculated as the most likely scenario. Prior to the pandemic, consumers typically booked 2 to 3 holidays per year, but will that continue with increasing costs, inflation, and looming recession?

Gavin Eccles predicts that current prices are unlikely to hold in the lower seasons and airlines may need to rethink their prices in order to retain demand. “ Airlines, and I expect many other travel companies from hotels to travel agencies, will need to reevaluate their revenue management strategies and we may see discounts implemented to stimulate demand,” he observes. Indeed, this downward trend has already started in the USA and is likely to spread in Europe and the Middle East.

Demand is still here, and consumers have not had their fill of travel yet. But cost could be a decision-making factor in the winter. We must note however that we are not seeing any signs from our hotels that prices will be lowered to stimulate demand. In fact, according to our September 2022 edition of The Hotelier PULSE Report, the majority of Hoteliers surveyed expect ADR to continue increasing over the next 12 months.

However, this could be adjusted based on any market changes that may arise in the coming weeks and months, as well as the subsequent consumer behavior.

3. Market Disruption in Winter followed by Decline in Demand

This is the worst case scenario, which could arise if we see a major market disruption, such as rising fuel costs or another Covid-19 Lockdown. As shown in the graph at the beginning of this section, we could see demand plummet to 2018 levels if this is the case. This is still a very positive scenario for hotels, as 2018 was a good year for the industry.

Conclusion

Looking back on 2022 so far, most of our predictions came to fruition. Furthermore, current market signals are pointing toward a positive end to the year and start to 2022. Of course, this could change given factors such as inflation, which is why we created three possible scenarios to help your planning and decision-making for next year.

What are your expectations for winter 2022 and 2023? Let us know in our latest Hotelier PULSE survey HERE.