Hotels in Portugal see 26% Revenue Increase amid booming Summer 2024 demand

Reading Time: 2 minutesAs hotels in Portugal approach the summer of 2024, the country’s allure as a vacation destination continues to strengthen. Starting the year with a robust 29% increase in demand compared to 2023, the Portuguese hotel sector is experiencing a significant uptick in bookings from June to August. The data from Guestcentric’s reference portfolio of 400 independent hotels, indicates that direct bookings remain the predominant choice for travelers, outperforming other channels like Booking.com. This trend is amplified by ongoing cancellations on third-party platforms, highlighting the resilience and appeal of strong independent hotels.

This year, average nightly rates for stays between June and August are set at €259, reflecting a 6% rise in prices to date and a 7% increase in future bookings compared to last year. The U.S. continues to lead as the primary market driving demand for stays in Portugal, closely followed by domestic tourists, stronger this summer than last year. The U.K., Germany, and Spain round out the top 5 in guest nationalities for the summer months.

All main regions in Portugal are reporting substantial increases in stays and revenue for summer 2024 compared to the previous year. Overall, the country has seen a 26% boost in revenue, a 20% rise in nights booked, and a 6% increase in pricing. Among the regions, Madeira showcases the most impressive revenue growth, surging by 55% compared to 2023, followed by the North with a 41% increase and the Azores at 40%. Both Madeira and the Azores have also seen considerable price hikes, up 19% and 18% respectively.

On a global scale, the travel and hospitality industry has surpassed its 2019 levels and shows no signs of deceleration, driven by robust consumer spending and a continuous shift towards normalcy in business travel. In the current market landscape, Expedia is gaining traction, particularly due to a surge in tour operators, consolidators and corporate bookings, while the influence of Online Travel Agencies (OTAs) seems to be waning. The B2B sector is becoming increasingly crucial. Projected to exceed $2.1 trillion in 2024, the combined revenue across air travel, hotels, vacation rentals, OTAs, and cruises reflects a buoyant market.

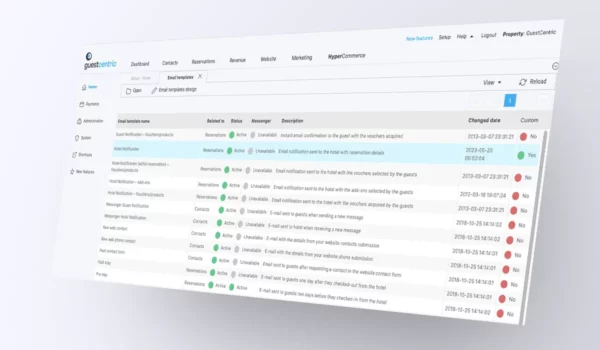

Nonetheless, the industry faces ongoing challenges such as low workforce retention and a tight labor market. To address these issues, hospitality providers are intensifying their adoption of innovative solutions in guest-facing, front-office and back-office operations to enhance guest experiences, employee engagement, improve operational efficiency, and maximize revenue.

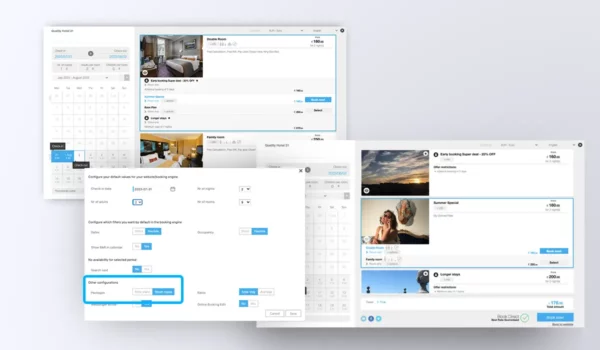

Moreover, as direct bookings remain the source of revenue with higher profit margins than those obtained through third-party platforms, hoteliers are increasingly leveraging technology to optimize their direct booking channels. By using advanced analytics, personalized digital strategies, and wider brand presence, hotels can better understand and anticipate guest needs, tailor their offerings, and attract more direct bookings.

In summary, as hoteliers navigate through the challenges of today’s labor market, their increasing investment in technology is not just a solution for improving efficiency and staff retention. It is a strategic approach to growing their direct business, enhancing guest experiences, and embracing sustainable practices, all of which are essential for staying competitive in a rapidly evolving industry.