5 Recession Lessons Hotels should Remember in 2022

Reading Time: 6 minutesPrior to March 2020, the tourism industry was booming worldwide. Hotels benefited from year-on-year growth in tourism and the continuous onslaught of guests during peak holiday seasons. As hotel business thrived, no one gave much thought to where their revenue was coming from, considered long-term investments, or clearly understood the implications to profitability.

As the industry bounces back by capitalizing on the revenge travel trend, it’s important that hoteliers remember the lessons learned from the recession, and apply them to their business for a stronger tomorrow. In this article, we analyze the lessons from the past 2 years, and what best practices hotels should implement in 2022 and beyond.

5 Hard Lessons Hotels have Learned from the Covid-19 Recession

By 2019, travel and tourism had ballooned into one of the most important sectors of the global economy. At the time, the industry accounted for 10% of global GDP and more than 320 million jobs worldwide. In that year alone, 1.5 billion people booked trips abroad, according to the International Monetary Fund. Hotels benefited significantly from the tourism boom, and in 2019 was worth over $570 billion, with over 700,000 hotels and resorts and 16.4 million hotel rooms worldwide.

But what goes up must come down, and by March 2020 Covid-19 poked a pin in the balloon of exponential economic growth for hotels. It also highlighted some painful truths about the loyalty (or lack thereof) of certain distribution partners, the unhappy consequences of short-term thinking in terms of cost and revenue, and just how much hotels had to upgrade their technologies to respond to rapid market changes.

Below are 5 significant lessons Hoteliers learned over the course of nearly two years since Covid-19 became a global economic crisis:

1. A Lack of Data-Driven Distribution at the expense of Revenue and Profitability

According to Phocuswright, global hotel gross bookings amounted to $523.7 billion in 2019. Online sales represented 42% of the total, and the OTAs captured two-thirds of that – approximately 50% for markets where hotel chains were present, and up to 80% for independent hotels.

OTA commissions can scale up to 30%, making them an expensive distribution channel, particularly when you consider how many hotels listed inventory for lower rates on OTAs compared to their hotel websites. According to pre-pandemic research by RateGain, up to 98% of 4-star hotels offered their rooms cheaper on OTA sites rather than on their own.

Revenue declines at the start of 2020 forced Hoteliers to take a closer look at managing costs and rethink their distribution strategies in tandem. According to research by STR published in February 2021, US revenue per available room plunged 47.5% year over year to $45.48 in 2020. Occupancy fell to 44%, and room rates declined 21% to $103 per night.

As a result, instead of selling discounted rooms to OTAs and incurring distribution costs as high as 15% to 20% of revenue, many hoteliers chose to keep distribution down to the 8% to 10% it costs to sell rooms on their own websites.

2. OTAs gave Hotels visibility and guests when times were good but did not help Hotels when the going got tough

At a time when hoteliers were fighting for the survival of their businesses, both Expedia and Booking.com abolished cancellation charges and introduced a blanket refunding of prepayments. As Hoteliers desperately tried to negotiate with guests and encourage them to postpone bookings rather than cancel, OTAs appeared to only be worried about catering to their service users, at the expense of their hotel partners.

In 2020, the major OTAs Booking and Expedia came under fire for these policy changes and for imposing extraordinary circumstances to make it easy for customers to cancel even non-refundable bookings at no cost.

By August 2020, The Bed & Breakfast Association in the UK called upon the Competition & Markets Authority to look into changes OTAs made to their terms and conditions since the coronavirus outbreak, which the Association’s Chairman David Weston highlighted as “damaging to small businesses”.

Many hotels subsequently rebelled against these practices by offering more flexible cancellations and refundable policies for customers who booked direct. Hotels also communicated directly with their clients, and travelers soon realized that the process of getting a refund via an intermediary website was considerably more complicated than directly with the hotel.

3. The pandemic forced Hoteliers to be creative with marketing their assets and diversify revenue sources

The idea of non-room revenue is by no means a new or groundbreaking concept, but when the pandemic triggered mass cancellations across the globe, Hoteliers were forced to creatively market their assets and diversify revenue sources.

According to Guestcentric research, the sale of vouchers increased significantly during the first year of the Covid-19 recession. By October 2020, over € 600K’s worth of romantic getaways, SPA, and monetary vouchers had been sold by over 1,000 hotels within the company’s portfolio.

Hotels also tapped into their F&B products to diversify revenue streams. At the Profit Talks Webcast hosted by HotStats in August 2021, Janine Williams, CEO, and founder, Impulsify, which creates grab-and-go spaces for hotels, said: “The hotel pantry was considered an amenity or even a cost-center before the pandemic, but in full-service, it has become an essential offering.”

According to Williams, this shift generated a reasonably healthy income for hoteliers in a time where room sales plummeted. She added, “We’re seeing food service running about $35,000 to $50,000 a month in sales from [grab-and-go outlets] at about 60% profit, and our select-service hotels are running $4,000 to 10,000 a month.”

4. With Nothing to Lose, Hoteliers upgraded Hotel Technology to Respond to Changing Market Conditions with Agility

When times were good, Hoteliers were content to sell rooms and watch business pour in, without considering the need to rethink or upgrade their tech solutions in response to guest demands. With change comes risk, and why would anyone want to risk investing in a new solution when the current one seems to be doing a “well enough” job?

But when the Covid-19 crisis triggered ever-changing and uncertain market conditions, the recession gave Hoteliers time to rethink their solutions and adapt them to the changing climate.

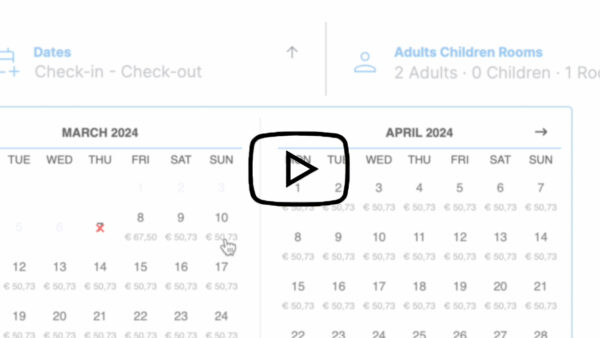

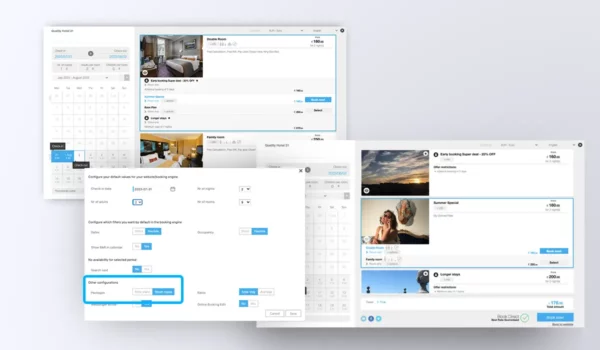

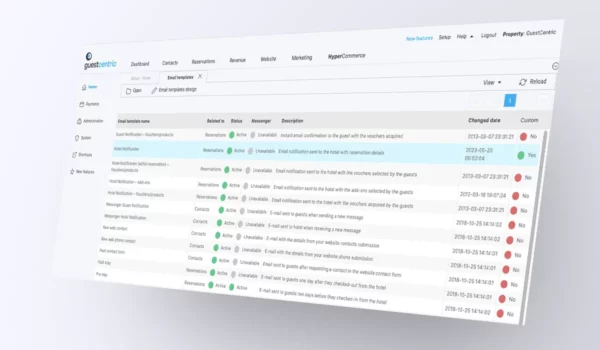

Hoteliers who have participated in our monthly Hotelier PULSE live panel, co-hosted with Techtalk.travel, have highlighted how the pandemic drove them to invest in upgrading their tech stack in response to changing market conditions. At our March 2021 live panel, Steffi Breitsprecher, Director of Revenue & Distribution at MEININGER Hotels, said: “We introduced a number of key projects in 2020, strongly focused on digital optimization for our website and IBE.”

Joining our Live Panel in June 2021, Ben Thomas, Chief Commercial Officer at Penta Hotels said: “Given the ongoing market uncertainty, we saw booking pace decrease drastically from 28 days to just 5 days or less. With mobile bookings on the rise, one of our first steps was to deploy a new mobile-first website. From there, we identified where prospective guests were searching for us online and implemented steps to increase visibility in these channels. All of our efforts have holistically focused on funneling the customer journey from search to the transaction.”

Highgate Ventures Principal, Kurien Jacob, said during the 2021 Hotel Data Conference, the COVID-19 pandemic “accelerated the digital transformation of hotels throughout the world.” He also pointed out that hotels have had to embrace tech that enabled automation ‘from the point of selling their rooms — distribution, pricing, revenue management — all the way up to contactless check-in’. “Hotels have also had to do more with less, so staffing at hotels has become a big issue. Hotels have figured out how to use technology … to help drive certain results with much less staff,” he said.

5. More Guests Reached out to Hotels Directly, fueling Direct Channel Resiliency and a Stronger Recovery in the Upturn

The crisis triggered a significant shift in guest booking behavior. Typically, price-conscious guests book with the OTAs because they expect these channels to deliver the most cost-effective deal. However, mass travel bans and cancellations highlighted a series of problems with OTAs, in terms of refunds and customer service.

These problems became evident in a report issued by the U.S. Department of Transportation. OTAs received 14,604 complaints from January to December 2020. Of those, 94% were about obtaining refunds for unused or lost tickets, fare adjustments, or bankruptcies.

Following unsatisfactory customer service and refund experiences with the OTAs, more and more guests began reaching out to hotels directly. Many hotels did an excellent job of responding with flexible options for guests to postpone bookings, and also in communicating what guests could expect at their booked destinations.

As a result, Guestcentric’s ongoing, monthly Hotelier PULSE Research shows the continuous direct channel resilience and growth in the recovery when benchmarked against leading OTAs, including Booking and Expedia. The majority of Hoteliers who participate in the monthly survey also continue to forecast direct channel growth in the industry’s recovery and beyond and intend to prioritize direct channel growth to become the top source of reservations in the future.

Hotel Business Looks Brighter in 2022, But Hoteliers should Not Forget the Hard Lessons from the Downturn

In line with growing vaccination rates worldwide, revenge travel is rapidly increasing on a global scale and market conditions are changing again. In September 2021, booked nights across all channels reached 118,69% of those over the same period in 2019, of which, 68% were international hotel bookings.

As we approach the end of this year, 75% of hoteliers surveyed for Guestcentric’s October 2021 Edition of the Hotelier PULSE Report expect to significantly increase revenue in 2021 vs 2020. Of those who shared this sentiment, 20% expect revenue to increase by 50% or more compared to 2020.

With business steadily picking up and projected to significantly and sustainably exceed pre-pandemic levels, it’s important that Hoteliers do not forget the hard lessons learned from the pandemic and fall back to old bad habits. Hotels must be agile enough to respond and capitalize on the post-covid travel boom while also contributing to long-term business growth and profitability.

Stay tuned for our next article about how your hotel can apply these lessons to your 2022 business strategy.